SaaS Metrics Madness — Part 2 of 2

In Part 1, we touched on the benefits and drawbacks of SaaS metrics. In this post, we’re focused on the SaaS metrics that matter at the seed stage (defined as those 0–36 months before you’ve raised institutional Series A money to dump the cash truck to SCALE).

tl;dr

Billings and burn are the only metrics that matter at the seed stage.

Cash is King (not just lip service)

Not surprisingly, the biggest risk to any seed stage business is running out of cash. At this stage, Founders generally do not have an institutional cap table that is able to provide lasting capital support in the form of ongoing (and dilutive) equity checks. As such, raising your way to sustainable cash flow generation is not a viable option. Even if it were, it’s not your best option.

I believe seed stage SaaS Founders and their supporters need to focus on the metrics that key them into how good they are at doing 2 things:

- Collecting Customer Cash (Maximize this)

- Conserving All Cash (Optimize this)

We’ll lay out a few metrics that do not require much beyond simple division (cash in/cash out) to give you and those looking at your business a sense for how things are going from a cash collection and conservation perspective.

More SaaS Metrics

Collecting Customer Cash

There a few ways you can bring cash into your business.

- Selling software products and services (Customer Cash)

- Selling securities — equity and equity-like financial products (Capital Provider Cash)

- Borrowing money — debt financial products (Capital Provider Cash)

We are focused on #1, becoming customer cash collection machines. Your customers will not dilute you, and their cash is your business’ best friend. So, let’s take a look at what really matters when it comes to customer cash.

$ Billings (Cash Collected)

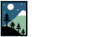

See Tom Tunguz’s illustration below. This represents a $12k annual contract value for a SaaS product billed quarterly. We are focused on cash collections (aka billings). Here’s another good read on bookings vs. revenue vs. billings from Leo Faria.

http://tomtunguz.com/four-important-numbers/

While it’s awesome to grow bookings and associated recognized revenue, it’s really sweet to get the cash in the door when you bill. I recommend looking at trailing and forward 3 and 6 months billings, built from your invoicing system (trailing) and your CRM (forward). These metrics will give a sense for the customer cash you can expect to come in the door over the next 3–6 months and how much of it your projected gross burn it will support.

Billings Growth Rate

I’m less concerned with your MRR growth rate or your bookings growth rate. I want to know how much you’re growing the customer cash you’re taking in. If you’re growing the customer cash you’re brining in from new customer acquisition and existing customer expansion (which I want to see split), I almost don’t care about the structure of the new contracts you’re putting out, because I can see the derivative cash coming in.

If I don’t see the cash coming in, I am going to question your new sales and retention efforts. Bookings can be misleading in that you may have booked a 3-year contract that only pays 10% year one and you’ve discounted your list price by 30% to close it. So, you’re $300k booking represents only $30k in cash, which may handle one payroll. MRR is just revenue recognition (accounting not cash).

Conserving All Cash

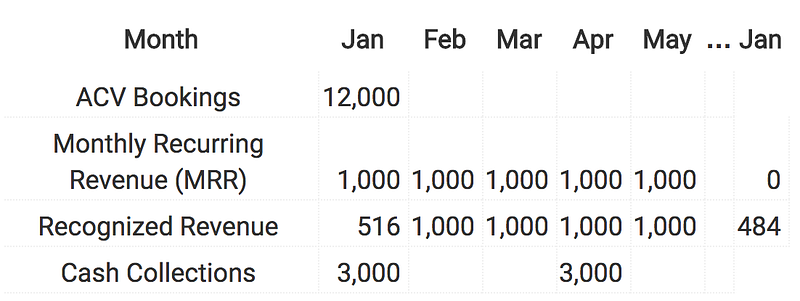

See David Skok’s illustration below. For our purposes, the ‘Conserve Cash’ region is the seed stage.

http://www.forentrepreneurs.com/saas-economics-2/

We are not talking about scaling businesses here. We are still in search mode. We’re growing. We’re learning. We’re not spending like hitting our next quarter’s top-line # depends on it (and nothing else really matters).

We’re in cash conservation mode with the goal of giving ourselves enough runway to execute in our search phase and get ourselves to a position where we are a compelling investment for capital providers (or even better, a self-sustaining business in our own right).

Gross Monthly Burn ($ total expenses)

How much money are you spending each month? I’m really interested in this $ spend as compared to your $ billings. Are you digging yourself a hole that you may not be in a position to get out of?

Much like recurring SaaS revenue can compound on itself, so can recurring, non-customer funded burn. Just beware of this, don’t let those expenses get away from you. Your payrolls are always more certain than your pipeline.

Let’s say your gross monthly burn is $50k and your gross monthly billings are $25k. That means you have a $25k delta to fund that is coming in the form of credit cards or other forms of borrowing, depleting your equity capital reserve, or stretching out your vendor payments (please don’t get in the habit of doing this, I mean 30–45 days may be ok, but beyond that you’re becoming unsustainable at this stage, you’re not Amazon).

Bridging Billings and Burn

Gross Burn Multiple: Monthly Gross Burn / Monthly Billings

How long you can weather a multiple greater than 1x is dependent upon your scale and capitalization. With $500k raised, $50k in gross burn and $25k in billings, you’re depleting 5% of your equity capital to fund burn. I like to see you cutting into this percentage, unless you have unit economics and capital support that warrant otherwise.

Runway: Cash & Equivalents / Net Cash Burn

(Cash balance + A/R balance <90 days + Available Credit) / (Monthly Gross Burn including cash and accrued debt service + A/P balance – Monthly Billings)

Note my non-mention of CAC, LTV, MRR growth rate. At this stage, there’s generally just not enough historical data from a duration or sample size perspective for these metrics to be truly meaningful. I like to see Founders thinking about / running the numbers on these metrics, but remember, at the seed stage, it’s all about the cash.